-

Origination is the better phase off credit characteristics that each personal need read to get financing, including a consumer loan, company mortgage, home loan, car finance, etcetera. Origination is a multiple-step techniques, ranging from software and you can underwriting in order to disbursal away from fund.

Every mortgage style of will receive other recognition techniques and you may conditions one to will likely be instructions and you can automated. The mortgage origination process might be paper-established or electronic. The fresh new digital process boasts the complete gamut of one’s loan origination procedure with just minimal files.

1. Pre-qualification processes

Pre-degree is the first faltering step on loan origination techniques. Mortgage applicant provides suggestions to your bank and/or alternative party such as for instance label/ address details, most recent a job information, earnings, commission background, taxation statements and you will expenses, and you will loan amount requisite. According to research by the provided recommendations and you will readily available financing alternatives, the lending company pre-approves the mortgage and renders a deal, making it possible for brand new debtor to continue.

Such, Rohit Bansal would like to rating home financing to acquire an excellent family worth Rs. 29 lakh. He is applicable into the mortgage on line knowing the amount and interest rate on that they are entitled to. The lender desires basic details about their earnings and you may present expenses. In accordance with the information, the lending company says Rohit is approved for a financial loan out of Rs. twenty five lakh. He must fill out data files and read far more acceptance process.

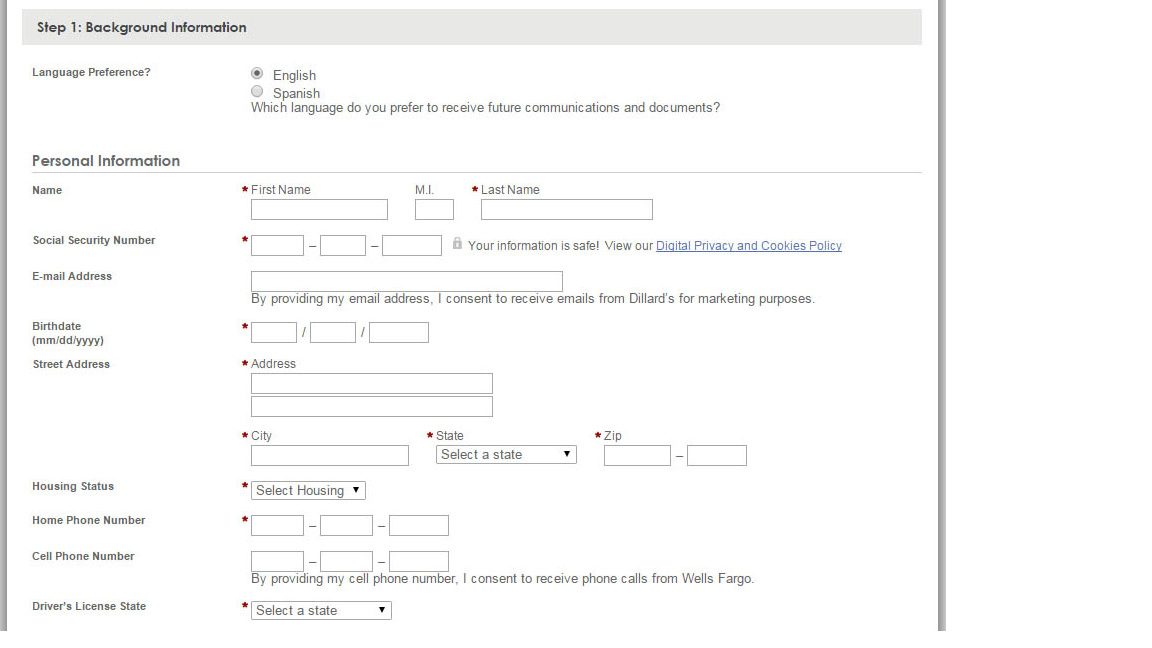

2. Documentation

Next stage of one’s mortgage origination processes are documents. New borrower should complete the app techniques by submission associated data so you’re able to substantiate money, a position, economic situation or any other history. New debtor can be complete the fresh data files on line from lender’s web site otherwise cellular application, or alternatively look at the nearby department of your bank add difficult duplicates.

step three. Application processing

Shortly after researching the program, the credit agencies recommendations they to own precision and completeness. Or no error is spotted regarding the software and/or candidate has not yet considering every recommendations needed, the financing analyst comes into contact toward mortgage applicant to help you procure the required missing information.

Loan providers essentially use Financing Origination Software (LOS) to assess the mortgage app. Depending on the formulas employed by a loan provider, an advanced LOS is immediately banner records having shed sphere and you can express they to the individuals to complete they.

cuatro. Underwriting process

The newest underwriting procedure performs a definitive character from the recognition regarding a loan application. The lender assesses the loan software against enough conditions such as for instance credit rating, risk get, financial obligation to money ratio, and installment skill. Some loan providers and additionally see the electronic footprints of your own financing debtor. The brand new underwriting procedure often is totally automatic with the aid of a corporate guidelines motor and you may API integrations from the loan origination system. From inside the a corporate laws and regulations system, lenders can include underwriting recommendations specific to help you points.

5. Borrowing from the bank choice

In accordance with the outcome of the underwriting process, the mortgage software program is recognized, denied otherwise repaid towards originator in order to procure considerably more details. A getting rejected may be reconsidered when the there are certain alterations in variables, like smaller amount borrowed, increased mortgage period or modified interest rates to lessen payments.

This step is also automated which have a law motor having an amount of predictability. Even lesser changes in the fresh variables, such as for example rates of interest, tenure and you can loan amount, shall be observed into the program rather than coding.

6. Top quality view

Consumer lending is actually tightly managed inside the Asia. Legislation require loan providers to steadfastly keep up conditions relating to resource adequacy, bucks reserve proportion, credit threshold, KYC norms, etcetera. And therefore, the quality control step is vital in order to lending establishments. The borrowed funds software is delivered to the quality manage queue to have auditing to ascertain complete conformity that have internal and external regulations and you will rules. This really is basically the last writeup on the program prior to disbursal. Quality control assists the lenders to quit any lawsuit and you will disciplinary action if there is a dispute.

seven. Loan Money

Very consumer financing was paid just like the mortgage data was finalized. Business financing, credit line and you will 2nd mortgages can take additional time to possess courtroom and you can compliance grounds. Bank products a otherwise demand draft, which you are able to located on the bank part or is couriered to the target. Sometimes, the borrowed funds matter is going to be paid on the bank account courtesy NEFT.

Automation of loan origination process

As previously mentioned before, individual lending are securely controlled in Asia. Legislative reforms allow it to be all the more difficult for lenders to make sustainable money avenues. A fully integrated, data-motivated financing origination system (LOS) will help loan providers spend less whenever you are cutting stage moments.

In a survey conducted by Moody’s Analytics, 56% of bankers responded that their biggest challenge in initiating the loan process was manual collection of data and subsequent back and forth with the client.

Maximize performance which have automation

Tips guide mortgage origination process are big date-ingesting and each action means human input to ensure full compliance that have laws. Guide and you will papers-situated underwriting methods is going to be contradictory and use up all your auditability and reliability. Customers prefer fast, smooth and you may problem-100 % free the means to access mortgage affairs. Because of the applying a business rules program, lenders will need to save money day on coverage-mainly based lines financing origination processes, expands output and you will decreases operational can cost you.

Customer-facing electronic sites and you will application system connects (APIs) encourages digital onboarding off current and possible client data straight to the new lender’s loan origination program. Next, lender-defined providers laws is also automate the second stages in the procedure, segregating the borrowed funds software which can be able to possess decision and you will software which have lost guidance.

Automation can also enjoy a very important part in helping borrowing experts. Cutting-edge financing origination options allow loan providers to interact the help of its commercial customer’s system through a web site portal, which have suitable permission. Such, lenders can also be map the relevant economic data to the a map out-of levels from the harmony layer, income/ expense, earnings and taxation models.

End

Marketplace around the globe have increased efficiency and you will efficiency with automation. Monetary community see page anxiously need advancement and you may freedom to stand economy challenges. not, the firm of originating small business and you can industrial funds remains focus on retrospectively in the sense it actually was decades back.

Conventional loan providers try facing intense race regarding tech-enabled opposition. Conventional finance companies must follow automation measures in their financing origination ways to satisfy modifying buyers requires or any other demands. Loan providers you to definitely admit a need to be more efficient, effective, and you can tuned in to their customers also need apply state-of-the-art technological choices. Automatic rules system permits loan providers to fulfill way more stringent regulating examination conditions.

Automation of the loan origination techniques constantly even offers the advantages of accuracy, near genuine-time study, increased show, and shorter decisioning times. When you find yourself automating the mortgage underwriting processes normally establish specific pressures, performing this can also be create the company photo due to the fact an inong co-worker.